Mumbai | October 13, 2025 — Tata Capital Ltd, a non-banking financial firm, is hoping to increase its loan book by a factor of two in the next three years, without increasing its credit costs to more than 1% according to the top management of the firm. Recent entry in the stock market also means that the company has counted on the robust growth of the SME lending segment and digital expansion

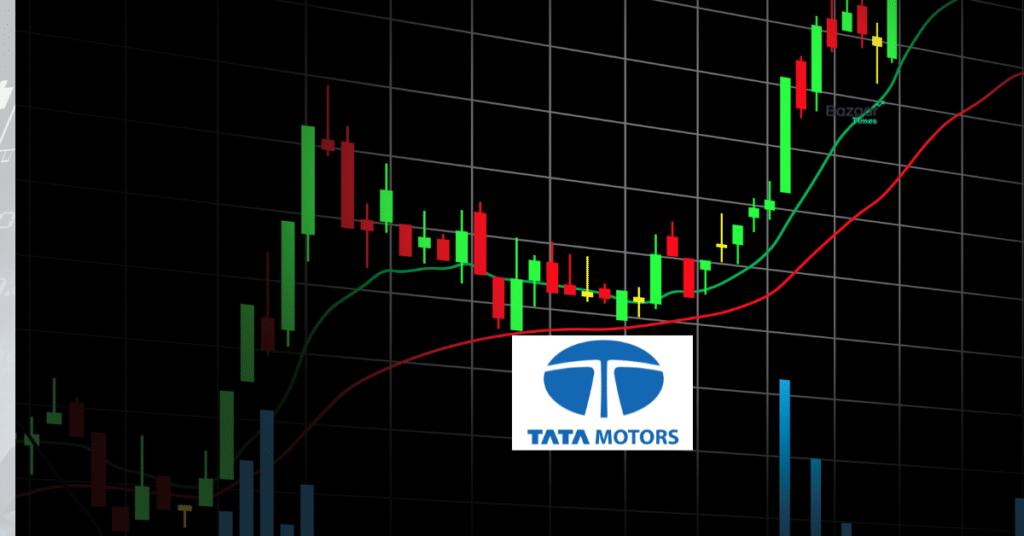

The announcement followed shortly after the IPO listing of Tata Capital, the shares of the company debuted at 1.23 percent above their issue price of 326. The stock improved by 1.50 per cent at mid-day trade on the BSE and NSE

Strong Growth Momentum

Rajiv Sabharwal, Chief Executive and Managing Director of Tata Capital informed the media that the loan book of Tata Capital was now 2.3 lakh crore in size and it had added 50,000 crore to its assets under management (AUM) in a single year

Sabharwal had said that if the growth rate of our country is maintained as we are optimistic about, then our book will be doubled in the next three years

Sabharwal further suggested that the amount of money obtained through the IPO will be enough to support the growth of the company over the next two and a half years

Concentrate on Liquidity and Efficiency

After Tata motors Finance was merged with Tata capital earlier this year, the credit rates increased temporarily to 1.4% but Sabharwal is hopeful that they will soon be cut to a lower level

He claimed we are sure to get below 1 percent in credit in the near future

Although there are industry-wide issues on the quality of assets in the MSME segment, Tata Capital is assured of the stability of its SME portfolio, which comprises a majority of more than 26 percent of total AUM

The credit quality is very strong and as such, we will be in a position to experience a very healthy growth in the SME sector as Sabharwal observed

Diversification and Strength of digital growth and resilience of interest rates

The Tata Capital still sources a majority of its loans directly, and is not reliant on co-lending facilities. The firm also anticipates that fluctuations in the interest rates would not affect its net interest margins (NIMs) since the company has a diversified portfolio of loans

Sabharwal says that the further improvement of efficiency and profitability of the company will be achieved due to the increased use of digital technologies

Placing India in the Growth Story

During the listing ceremony of the company, Tata Sons Chairman N Chandrasekaran and Tata Capital Chairman Saurabh Agrawal emphasized the belief of the group in the economic trend in India

Agrawal, who also doubles as Group CFO of Tata Sons, opined that the total credit outstanding in India will have exceeded 500 lakh crore in the next five years and Tata Capital is best placed to take advantage of that

Agrawal added that with uncertainty about the global economy, the growth story of India continues to pick up and gather momentum, and with GST rationalization, income tax cuts, and reduction of the RBI rates, domestic demand is also being stimulated

Conclusion

Having good fundamentals, strategic capital inflow, and a clear outlook on digital-led growth, Tata Capital is preparing to enter the ambitious growth phase. With the Indian financial ecosystem evolving further, the company expects to solidify itself in the retail, SME, and infrastructure lending divisions and this will precondition sustainable growth in the future.